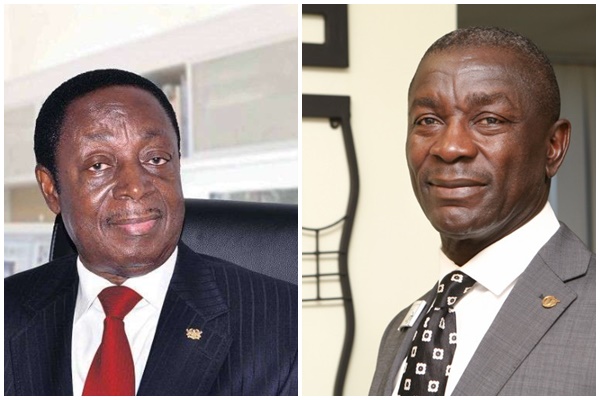

Two businessmen, Prince Kofi Amoabeng and Dr. Kwabena Duffuor have petitioned Parliament to investigate the Bank of Ghana and the Ghana Stock Exchange following the revocation of the license of their respective financial institutions.

Dr. Duffuor, founder of now-defunct uniBank and Mr. Amoabeng, former Chief Executive Officer of collapsed UT bank, had the licenses of their respective financial institutions revoked during the banking sector clean-up exercise which commenced in 2017.

For UT Bank, the apex bank claimed it took the action against the institution because it was insolvent and was unable to recapitalise despite several assurances from the company’s shareholders.

The apex bank also gave similar reasons for the revocation of uniBank’s license saying the financial institutions was significantly undercapitalized.

While uniBank was merged with four other banks to form the Consolidated Bank Ghana Limited, the Bank of Ghana gave GCB permission to takeover UT bank.

Dr. Duffuor is currently litigating the collapse of his bank.

Mr. Amoabeng per documents sighted by Citi News said his bank’s license was revoked “without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.”

He is thus asking Parliament to direct the restoration of the license.

Below are excerpts of his requests to Parliament:

- Investigates the conduct of the Bank of Ghana and the Ghana Stock Exchange for the revocation of UT Bank’s license and delisting the bank without due regard to the rules of Administrative Justice guaranteed under article 23 of the 1992 Constitution.

- Directs the restoration of the banking license of UT Bank Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

- Gives any other directives that Parliament may deem appropriate.

Dr. Duffour is also asking the house to investigate the “take over appointment of an Official Administrator of uniBank Ghana Limited”.

He is also asking the House to remedy the “harm” done to the shareholders.

Below are excerpts of his requests:

- Investigates the conduct of the Bank of Ghana in the takeover, the appointment of an Official Administrator of uniBank Ghana Limited, and the circumstances of the revocation of the banking license of uniBank Ghana Limited;

- Directs the restoration of the banking license of uniBank Ghana Limited by the Bank of Ghana and the remedying of the harms done to the shareholders’ property rights as a result of the conduct of the Bank of Ghana.

- Gives any other directives that Parliament may deem appropriate.

The petition is to officially be presented before Parliament on Tuesday, March 23, 2021, for the appropriate directives to be issued by the Speaker of Parliament.

Banking sector reforms

The financial sector clean-up commenced by the Akufo-Addo administration in August 2017 led to the collapse of nine universal banks, 347 microfinance companies, 39 microcredit companies or money lenders, 15 savings and loans companies, eight finance house companies, and two non-bank financial institutions.”

The Securities and Exchange Commission (SEC) also announced the revocation of licenses of 53 Fund Management Companies.

The total estimated cost of the state’s fiscal intervention, excluding interest payments, from 2017 to 2019 was pegged at GHS16.4 billion.

Source: citifmonline

Comments