Content

- Temporary and Permanent Accounts

- What is Post Closing Trial Balance?

- Why doesn't the balance sheet equal the post-closing trial balance?

- AccountingTools

A post-closing trial balance will be formatted the same as the other two types of trial balances that have already been discussed. Like an unadjusted or an adjusted trial balance, it will have accounts listed in order of either their account numbers or in the order they appear on the balance sheet. The order that will follow will be assets first, then liabilities and finally ending off with equity. A trial balance also comes in handy to preparing the financial statement. A company needs to prepare a Profit & Loss, Balance Sheet, and Cash Flow statement at the end of each accounting period.

- The adjusted trial balance shows the final or closing balances of all general accounts in the ledger after adjustments have been made.

- The balance in Income Summary is the same figure as what is reported on Printing Plus’s Income Statement.

- The word “post” in this instance means “after.” You are preparing a trial balance after the closing entries are complete.

- The Printing Plus adjusted trial balance for January 31, 2019, is presented inFigure 5.4.

The post-closing trial balance contains real accounts only since all nominal accounts have already been closed at this stage. https://online-accounting.net/ Posting accounts to the post closing trial balance follows the exact same procedures as preparing the other trial balances.

Temporary and Permanent Accounts

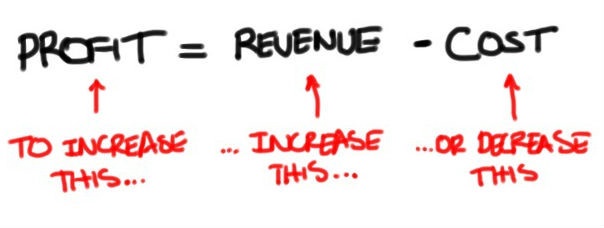

This means that it is not an asset, liability, stockholders’ equity, revenue, or expense account. The account has a zero balance throughout the entire accounting period until the closing entries are prepared. Therefore, it will not appear on any trial balances, including the adjusted trial balance, and will not appear on any of the financial statements. The last step in the process is preparing the post-closing trial balance. The big difference between this and the other trial balances is that the balance in the revenue and expense accounts should be zero. List all of the accounts and their balances in the appropriate debit or credit columns.

A post closing trial balance is the third trial balance in the accounting cycle and lists all of a company’s accounts that have remaining balances after a company’s closing entries have How To Prepare A Post Closing Trial Balance been made. Permanent accounts are accounts that transfer balances to the next period and include balance sheet accounts, such as assets, liabilities, and stockholders’ equity.

What is Post Closing Trial Balance?

No matter which way you choose to close, the same final balance is in retained earnings. Finally, when the new accounting period is about to begin, you would run the post-closing trial balance, which reflects your totals going forward into the new accounting period. All trial balance reports are run to make sure that debits and credits remain in balance. Do recall in Module 2 when you first looked at the Statement of Retained Earnings that withdrawals and dividends are taken out of the retained earnings account. Again, this checks out too since retained earnings is a credit balance account so to decrease it , you will debit retained earnings. Now that you know the RED accounts are those that need to be closed, let’s see how this is being carried out.

What is included in the post-closing trial balance?

The post-closing trial balances shows only the permanent account closing balances. This is also known as the closing balance sheet.

Comments