The Minority Leader, Dr Cassiel Ato Forson, has fiercely criticized the government’s proposed new taxes on akpeteshie, petrol, and diesel, labelling them as a sign of the government’s lack of innovative ideas to manage the economy.

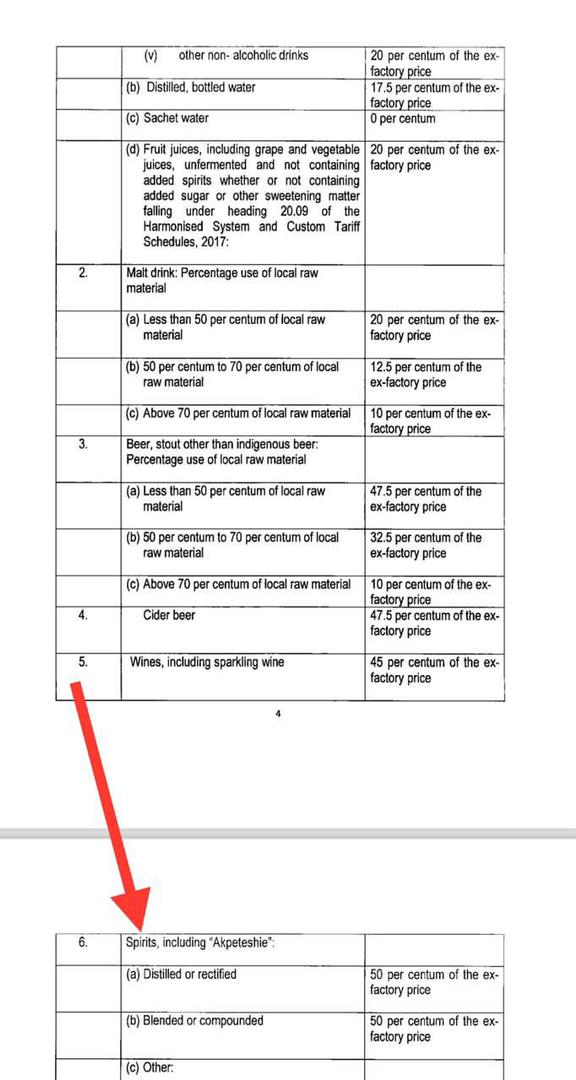

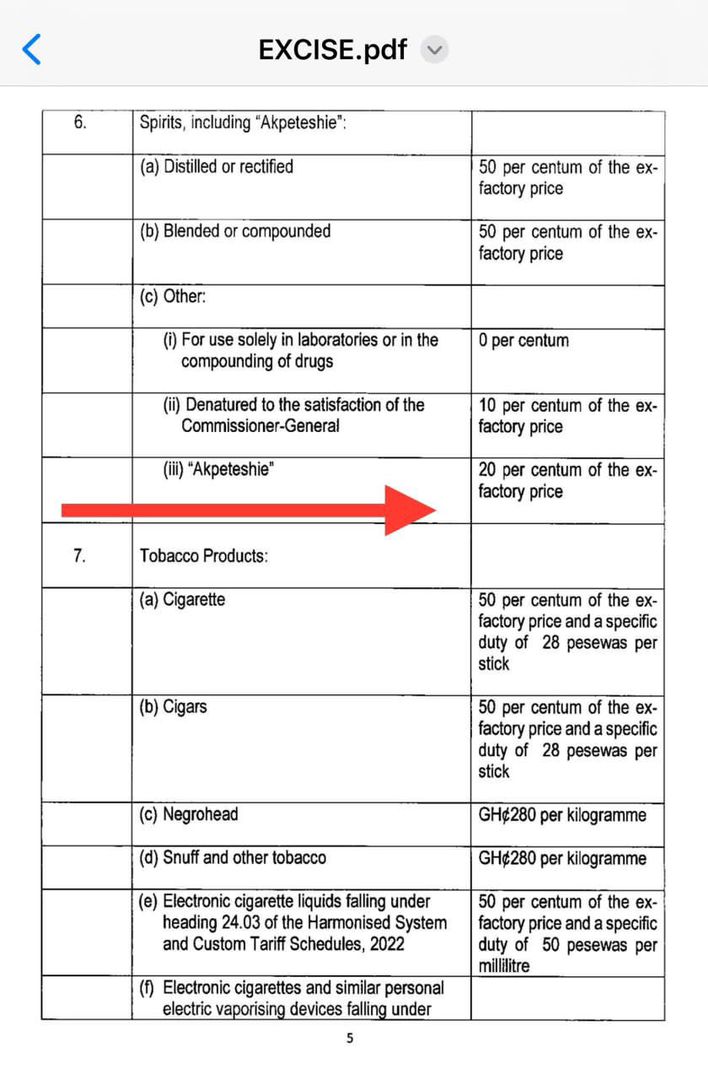

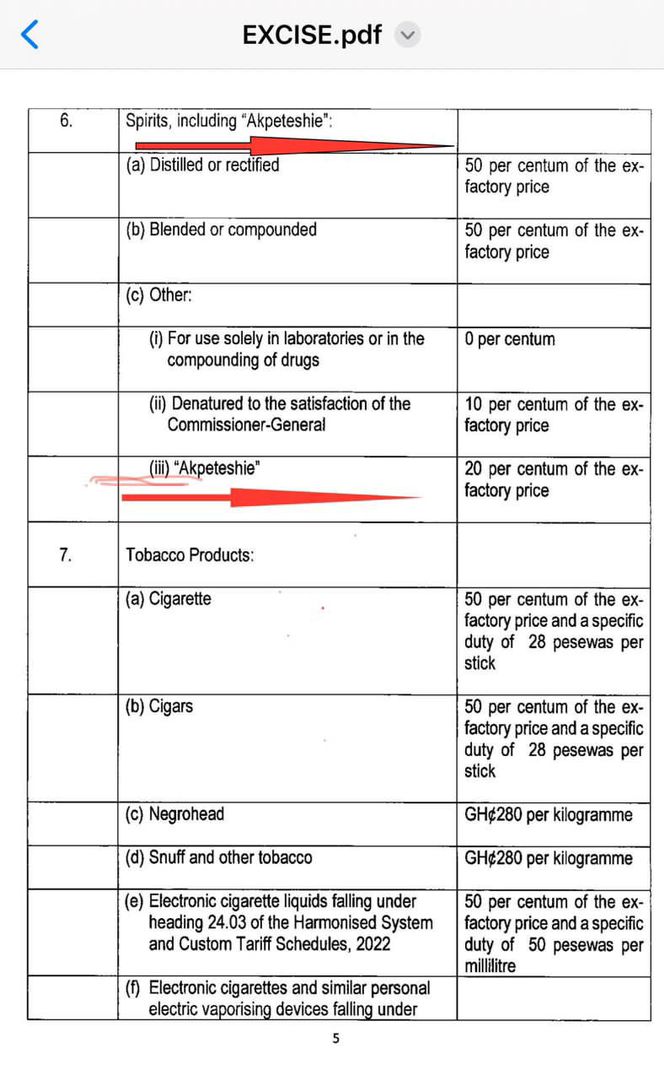

In a strongly worded statement, Dr Forson lambasted the government’s decision to impose a 20% tax on akpeteshie, a local alcoholic beverage, highlighting the potential negative impact on local producers and consumers.

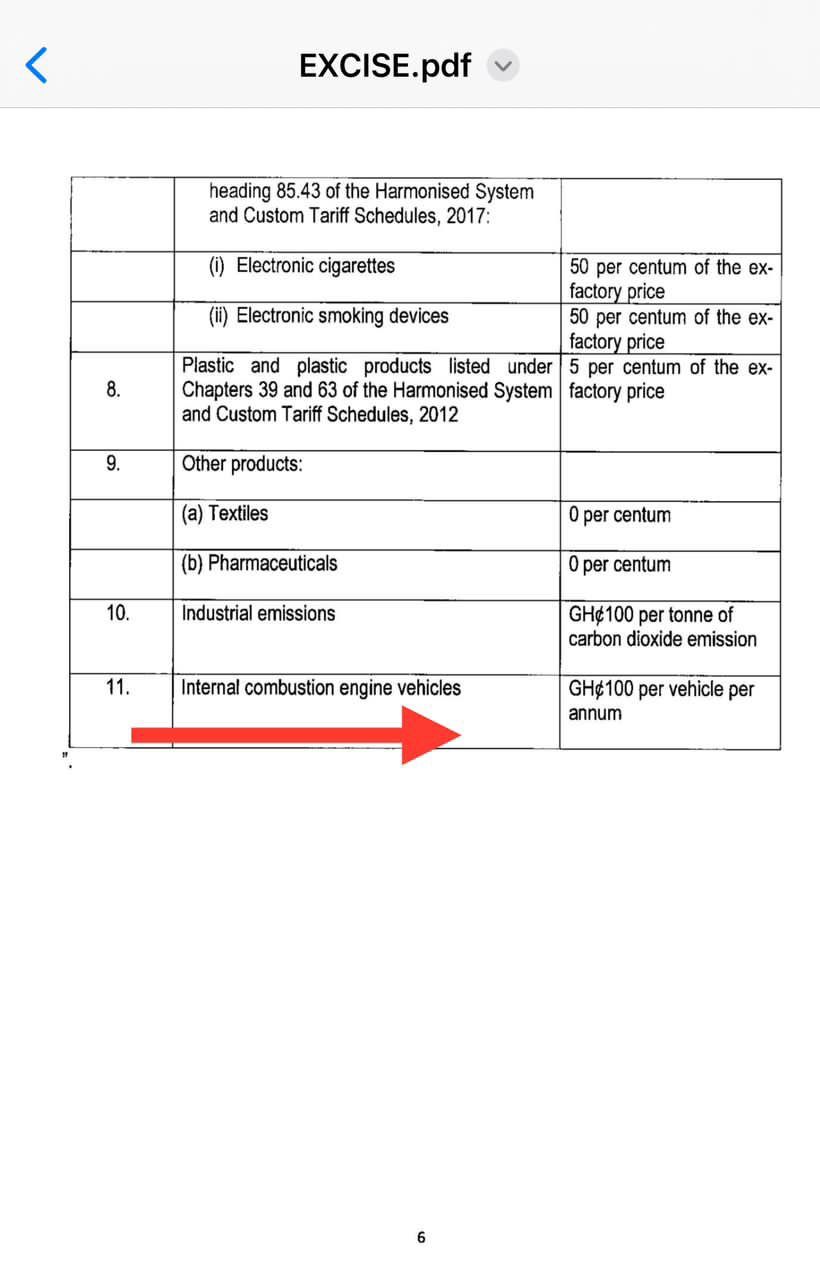

He further denounced the proposed annual tax of GHC100 on all petrol and diesel vehicles, encompassing trotros, aboboyaas, okadas, taxis, commercial buses, and ambulances.

Dr Forson asserted that the government’s justification for these taxes, promoting the use of cleaner energy sources like electric vehicles, was a mere smokescreen for its true motive of generating additional revenue.

He emphasized that the government’s lack of creativity in devising effective economic policies had led it to resort to indiscriminately taxing the populace.

“This government indeed has an insatiable appetite for taxes. The Akufo-ddo/Bawumia government is imposing 20% tax on “akpeteshie” (they have run out of ideas). Petrol and diesel vehicle owners should also expect to pay a new annual tax of GHS100 per vehicle on all petrol and diesel cars (internal combustion engine vehicles).”

“This tax will be imposed on all trotros, aboboyaas, okadas, taxis, commercial buses, trucks, ambulances, construction and heavy-duty vehicles, water tankers, private cars, etc. Once your vehicle is powered by petrol or diesel, the government is imposing this tax on you.”

READ THE FULL STATEMENT FROM THE MINORITY LEADER BELOW

Minority Leader, Dr Ato Forson writes;

Fellow Ghanaians,

This government indeed has an insatiable appetite for taxes.

The Akufo-Addo/Bawumia government is imposing 20% tax on “akpeteshie” (they have run out of ideas).

Petrol and diesel vehicle owners should also expect to pay a new annual tax of GHS100 per vehicle on all petrol and diesel cars (internal combustion engine vehicles).

This tax will be imposed on all trotros, aboboyaas, okadas, taxis, commercial buses, trucks, ambulances, construction and heavy-duty vehicles, water tankers, private cars, etc.

Once your vehicle is powered by petrol or diesel, the government is imposing this tax on you.

According to the government, this policy is aimed at promoting the use of cleaner/more eco-friendly sources of energy (like electric vehicles). 😳

Companies will also pay be GHS 100 per tonne of carbon dioxide emission.

This is according to a tax bill submitted by President Akufo-Addo and Vice President Bawumia.

Comments