The Bank of Ghana reported a 30.31 percent oversubscription in its latest treasury bill auction held on January 23, 2026, marking the eighth consecutive auction to be oversubscribed.

Investors submitted a total of GH¢12.8 billion in bids, exceeding the government’s target of GH¢9.82 billion, indicating strong demand for short-term government securities.

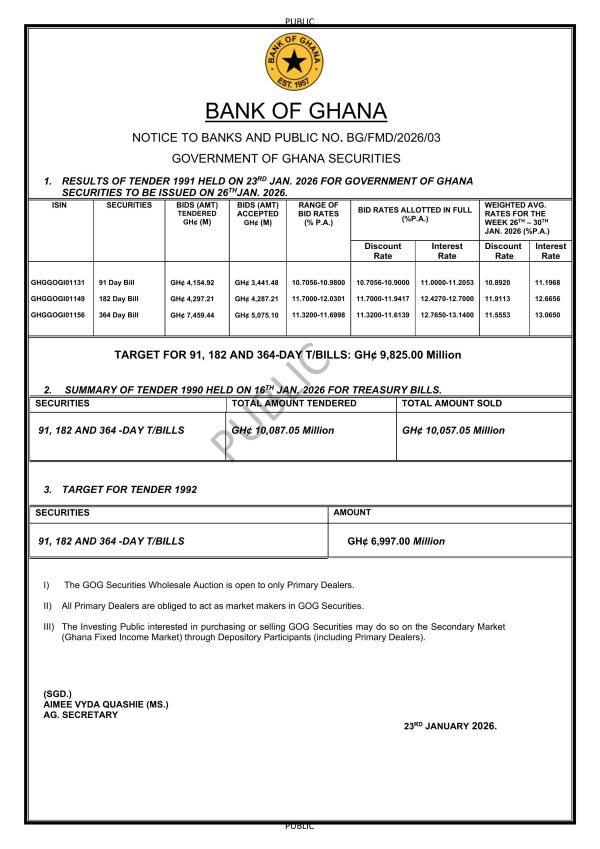

The 364-day treasury bill attracted bids totaling around GH¢7.45 billion, of which the government accepted GH¢5.07 billion. The 182-day bill received bids of about GH¢4.29 billion, with nearly all (GH¢4.28 billion) accepted. Meanwhile, the 91-day bill recorded bids of GH¢4.15 billion, with GH¢3.44 billion approved.

Yields on the bills showed mixed movements. The 91-day bill yield held steady at 11.19 percent, while the 182-day bill rose slightly to 12.66 percent from 12.64 percent in the previous auction. The 364-day bill yield increased by eight basis points, settling at 13.06 percent, reflecting continued investor interest in longer-dated short-term instruments.

The results demonstrate sustained investor confidence in government securities and a strong appetite for treasury bills as a safe investment option.

Comments