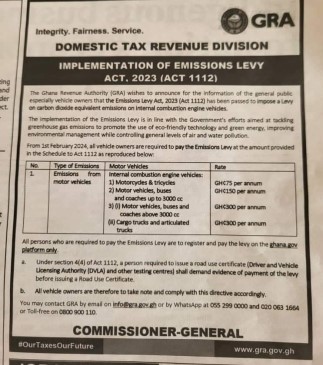

The Emissions Levy Act, 2023 (Act 1112), which imposes a levy on carbon dioxide equivalent emissions on internal combustion engine vehicles comes into effect today – February 1, 2024, the Ghana Revenue Authority (GRA) has announced.

The move forms part of the government’s efforts aimed at dealing with greenhouse gas emissions to encourage the use of green energy and eco-friendly technology to enhance environmental management and reduce overall pollution levels in the air and water.

Effective today, Thursday February 1, 2024, every vehicle owner is required to pay the Emissions Levy at the amount provided in the schedule to Act 1112.

The type of vehicle and engine capacity determine the amount of the tax. Motor vehicles, buses, and coaches up to 3000 cc must pay GH₵150 annually, while motorcycles and tricycles must pay GH₵75 annually. GH₵300 must be paid annually for motor vehicles, buses, coaches, and articulated lorries with a displacement greater than 3000 cc.

Levies;

1) Motorcycles & tricycles – GHC75 per annum

2) Motor vehicles, buses and coaches up to 3000 cc – GHC150 per annum

3) (i) Motor vehicles, buses and coaches above 3000 cc – GHC300 per annum

(ii) Cargo trucks and articulated trucks – GHC300 per annum

All individuals who must pay the emissions fee must register and do so exclusively through the ghana.gov portal. A road use certificate must be issued by the Driver and Vehicle Licencing Authority (DVLA) and other testing centres in accordance with section 4(4) of Act 1112, and before doing so, they must get proof that the levy has been paid.

The GRA in a public notice has urged all vehicle owners to comply with the directive.

In accordance with international agreements, the Emissions Levy Act, 2023 (Act 1112) is a historic piece of legislation that aims to reduce the harmful health impacts of carbon dioxide-related environmental pollution.

Comments